The Influencer Marketing Benchmark Report 2023 is our latest overview of the influencer marketing industry. It summarizes the thoughts of more than 3500 marketing agencies, brands, and other relevant professionals regarding the current state of influencer marketing, along with some predictions of how people expect it to move over the next year and into the future.

The world around us has changed considerably over the last few years. The arrival of Covid in 2020 turned much of the world on its head, with enforced lockdowns and scenes reminiscent of a Hollywood disaster movie. By 2022, however, much of the world was learning to live with Covid, clamoring for something resembling their old lives. Unfortunately, they were also learning to live with the economic consequences of Covid, with supply chain disruptions, a chronic shortage of key workers, and creeping inflation threatening to unsettle the global economy.

Unsurprisingly, many businesses have struggled to survive in the new environment. And those that have made it this far are needing to find new ways to market, so they stand out in the minds of consumers. Creator and influencer marketing appear to be more important than ever for connecting brands with their target customers.

As well as our annual survey collating data related to the influencer marketing industry, the Influencer Marketing Benchmark Report 2023 also collects data from our partner, HypeAuditor, and our Diversity, Equity & Inclusion (DEI) in Influencer Marketing: Racial and Gender Inequalities Report 2022.

The State of Influencer Marketing Benchmark Report 2023:

- Notable Highlights

- Survey Methodology

- Influencer Marketing Expected to Grow to be Worth $21.1 Billion in 2023

- Sizeable Increase in Content in Recent Years, But Rate Slowing

- An Increasing Majority Have a Standalone Budget for Content Marketing

- 63% of Respondents Feeling the Impact Of 2023’s Macroeconomic Woes

- The Vast Majority of Respondents Still Believe Influencer Marketing to be Effective, Though There is More Negative Thinking Than Previously

- More Than 80% of Our Respondents Intend to Dedicate a Budget to Influencer Marketing in 2023

- 67% of Respondents Intend to Increase Their Influencer Marketing Spend in 2023

- 23% of Respondents Intend to Spend More Than 40% of Their Marketing Budget on Influencer Marketing

- Although Most Brands Spend Less Than $50K on Influencer Marketing, More Than 11% Spend Over $500K.

- Firms Value Working with Influencers They Know

- More Than 60% Plan to Use AI or ML in Their Influencer Campaigns

- The Main Purpose of AI/ML Will be for Influencer Identification

- TikTok Still Expected to Deliver the Best ROI for Short-Form Video

- Strong Preference for Smaller Influencers

- More Brands Now Pay Influencers Than Give Them Free Product Samples

- Major Change in Payment System This Year: More Than Half of Payments to Influencers are Made as a Percentage of Sale

- PayPal is Marginally the Most Popular Way to Pay influencers, However, Other Methods Are Almost as Common

- Nearly 75% of Brands Track Sales from Influencer Campaigns

- Email Addresses and Referral Links are the Most Popular Ways to Attract Sales

- 80%+ Recognize the High Quality of Customers from Influencer Marketing Campaigns

- 60% of Respondents Have Used Virtual Influencers

- 71%+ Measure the ROI on Their Influencer Marketing

- The Most Common Measure of Influencer Marketing Success is Views / Reach / Impressions

- Most Consider Earned Media Value a Good Measure of ROI

- 83% of Firms Take Their Influencer Marketing Spending from Their Marketing Budget

- 72% of Influencer Marketing Campaigns are Run In-House

- 71% of Respondents Use Tools Developed In-House to Execute Influencer Marketing Campaigns

- 60% of All Respondents Use 3rd-Party Platforms

- The Most Popular Use of Influencer Platforms is for Influencer Discovery and Communication

- TikTok is Now the Most Common Channel Used by Most Brands Engaging in Influencer Marketing

- User Generated Content (UGC) is Now the Main Objective for Running an Influencer Campaign

- Influencer Fraud is Still of (Some) Concern to Respondents

- Continued Fall in Respondents Who Have Experienced Influencer Fraud

- Brands are Finding it Relatively Easy to Find Appropriate Influencers

- The Majority of Firms Have Little Concerns About Brand Safety in Influencer Campaigns

- More Than 75% Believe Influencer Marketing Can be Automated

- Content Production is Now Considered Most Valuable When Partnering with Influencers, But Audience Relationship is Still Valued

- 60% of Respondents Prefer Their Influencer Marketing to be Campaign-Based

- The Vast Majority Consider Influencer Marketing to be a Scalable Tactic in their Marketing Ecosystem

- Views/Reach/Impressions Are Now the Most Important Criteria When Evaluating Influencers

- 60%+ of Brands Work with More Than 10 Influencers

- Monthly Campaigns Are Now the Most Used, With the Use of Quarterly Campaigns Falling Dramatically

- Finding Influencers to Participate is Again the Greatest Challenge for Those Who Run Campaigns In-house

- Social Media User Demographics Statistics

- The Majority of Instagram Users Are Aged 25-34

- TikTok is the Favorite of 13–24-Year-Olds.

- 57% of YouTube Viewers Are Male, But Females Dominate the Younger Age Groups

- Influencer Engagement

- Instagram Influencer Fraud Has Continued to Decline Since 2019

- The Most-Mentioned Brands on Social Media in 2022

- Target Was the Most Mentioned Brand on TikTok in 2022

- Diversity, Equity, and Inclusion (DEI) in Influencer Marketing:

- Nearly 60% of Influencers Felt They Faced Discrimination

- Almost 50% of Influencers Face Discrimination Based on Their Gender

- TikTok Provided the Worst Discrimination Faced by Influencers

- Macro- and Mega-Influencers Suffer Most from Discrimination

Notable Highlights

- Influencer Marketing Industry is set to grow to approximately $21.1 Billion in 2023

- 63% plan to use AI in executing their influencer campaigns, 2/3rd of these brands will use AI for influencer identification

- Nearly 60% of influencers felt they faced discrimination in 2022

- Over 83% of our survey respondents still believe influencer marketing to be an effective form of marketing

- 71% admit to having increased the amount of content they produce and share

- 67% of those respondents who budget for influencer marketing intend to increase their influencer marketing budget over 2023

- 23% of respondents intend to spend more than 40% of their entire marketing budget on influencer campaigns

- There is a strong preference for working with small (nano - 39% and micro - 30%) influencers ahead of expensive macro-influencers (19%) and celebrities (12%)

- It is now the norm to pay influencers (42%), rather than just give them a free product (30%).

- TikTok (utilized by 56% of brands using influencer marketing) is now the most popular influencer marketing channel, jumping ahead of Instagram (51%) for the first time, and well ahead of Facebook (42%) and YouTube (38%).

Survey Methodology

We surveyed approximately 3500 people from a range of backgrounds. 38% of our respondents worked at marketing agencies (including those specializing in influencer marketing), and 22.5% considered themselves brands (or brand representatives). 4% are PR agencies. We merged the remaining 35% as Other, representing a wide range of occupations and sectors.

Last year, we saw a relative increase in B2B businesses over B2C firms compared to 2021. However, very little has changed this year, with the comparative percentages remaining almost identical. 62% of those surveyed identify as part of the B2C sector, with the remaining 38% running B2B campaigns.

The most popular vertical represented remains Fashion & Beauty (25% of respondents), although this is up considerably from last year's 15%). Gaming became the second-most popular sector (12.9%), followed by Travel & Lifestyle (12.5%). At 12%, Sports were three times as popular this year than last. Family, Parenting & Home (10.7%) also have increased representation in 2023. The big drop, however, was in Health and Fitness (6.8%). The remaining 19%, grouped as Other (and half the equivalent 2022 percentage), covers every other vertical imaginable.

We have noticed a more global response to this year’s survey. 31% of our respondents come from Africa (5% in 2022), 16% came from the USA (57% in 2022), 14% from Asia (APAC) (13% 2022), 8% from Europe (11% 2022), 4% South America (2% 2022), and 28% describe their location as Other (11% 2022). It is highly likely that many respondents who selected Other in 2022, have been more precise in 2023’s survey.

The bulk of our respondents came from relatively small organizations, with 38% representing companies with fewer than ten employees. 21% had 10-50 employees, 12% 50-100, 12% 100-1,000, and 16% came from large enterprises with more than 1,000 employees. Overall, however, there are twice as many respondents from larger organizations than last year, which might have a small impact on the comparative results.

Slightly more of our respondents operate eCommerce stores than those who don't. For example, 51% of the respondents run eCommerce stores versus 49% not doing so. This represents a small but noticeable decrease in the percentage of influencer-contracting brands operating eCommerce stores. Last year, almost 54% of such brands ran eCommerce stores.

This is surprisingly high. Remember that our survey respondents come from various backgrounds – brands, marketing agencies, PR agencies, and "Other." Clearly, eCommerce is increasing in popularity for all types of businesses.

However, one thing to be aware of is that the Influencer Marketing Hub now caters to all types of eCommerce. A more significant portion of the site is now devoted to articles about eCommerce than in previous years. As a result, we may have a higher percentage of eCommerce marketers (compared to influencer marketers) visiting the site and answering our survey than previously.

Influencer Marketing Expected to Grow to be Worth $21.1 Billion in 2023

Despite concerns that influencer marketing (indeed, all marketing) might decrease due to Covid19, it didn’t, and has continued to increase in popularity since 2020. Initially, some industries, such as tourism and airlines, had to retrench dramatically and cut back their operations and marketing, but many others adjusted their models to survive in the Covid and post-Covid world. Now there is even renewed life in those more Covid-affected industries.

Over the last year, we have experienced a global economic downturn, and increasing inflation rates, making it more difficult for people to pay for their everyday purchases, nevermind perceived extras. Firms are having to compete more fiercely for the consumer’s dollar, pound, or euro. Successful businesses understand the importance of marketing, including influencer marketing, in tough times, and increase their expenditures on this, even when they have to cost-cut expenses elsewhere.

From a mere $1.7 billion at the time of this site's beginning in 2016, influencer marketing grew to have an estimated market size of $16.4 billion in 2022. Furthermore, this is expected to jump a further 29% to an estimated $21.1 billion in 2023.

Results From Our Survey

Sizeable Increase in Content in Recent Years, But Rate Slowing

We asked our respondents whether they had increased content output over the last two years. A sizable 71% of them admitted to having upped the amount of content they produced. This is, however, noticeably down on last year's 84%.

Despite the comparative fall in increased content, many firms still realize the insatiable demand for online content. The majority of marketers have still increased their content marketing, year after year. Much of this increase in content must be created and delivered by influencers on behalf of brands. Clearly, new content is continually being developed and shared over newer social networks like TikTok.

An Increasing Majority Have a Standalone Budget for Content Marketing

Nearly 2/3 (63%) admit to having a standalone budget for content marketing. This figure creeps up each year and is up from 61% last year, 59% in 2021, and 55% in our 2020 survey.

Yet, although these figures are over 50%, they are surprisingly low. For example, HubSpot reports that 82% of their respondents used content marketing in 2021, up from 70% in 2020. HubSpot also found that almost half (49%) of marketing teams allocate between 30% and 50% of their budget to content.

Perhaps the discrepancy simply reflects that some firms operate a single marketing budget rather than separating it into the different types of marketing they use.

63% of Respondents Feeling the Impact Of 2023’s Macroeconomic Woes

The world economy is currently in its most challenging situation since the arrival of influencer marketing. So, it was interesting to see whether the Marketing Departments at our respondent businesses are feeling the pinch. Indeed, 63.2% of our respondent businesses are feeling the impact of 2023’s macroeconomic circumstances.

The Vast Majority of Respondents Still Believe Influencer Marketing to be Effective, Though There is More Negative Thinking Than Previously

Unsurprisingly, considering the overall positive sentiment expressed about influencer marketing, just over 83% of our survey respondents believe influencer marketing is an effective form of marketing.

This statistic has exceeded 80% in each of our surveys since 2017, however, it is noticeably lower than last year’s 90% support. It is still clear, however, that most firms that try influencer marketing are happy with the results and are willing to continue with the practice. You may read the odd horror story in the media, but that is the exception to the rule. Perhaps the reason for this year’s more pessimistic perspective is the economic downturn most of the world is currently enduring. Most influencer marketing partnerships work however and are a win-win situation for all parties.

More Than 80% of Our Respondents Intend to Dedicate a Budget to Influencer Marketing in 2023

The general satisfaction felt by firms that have engaged in influencer marketing seems to flow through to their future planning. For example, 82% of our respondents indicated that they would be dedicating a budget to influencer marketing in 2023.

This is a noticeable increase from last year's 77% result and considerably up from the 37% who claimed they would dedicate a budget in our first survey in 2017. This increase could result from firms increasing marketing to combat the effects of the current global financial crisis.

67% of Respondents Intend to Increase Their Influencer Marketing Spend in 2023

67% of those respondents who budget for influencer marketing intend to increase their influencer marketing budget over the next 12 months. An additional 15% indicate that they expect to keep their budgets the same as in 2023. A further 11% stated that they were unsure how their influencer marketing budgets would change. This leaves just 7% intending to decrease their influencer marketing budgets.

These results suggest significantly increased spending on influencer marketing in 2023, following on from similar-sized boosts in 2022. The 7% planning to decrease their influencer marketing budget is double 2022's 3% figure, however, but is comparable to 2021’s results.

Overall, this is further proof that influencer marketing continues to be successful and is now sufficiently mainstream that it can’t be considered just a fad. Brands and marketers still recognize the effectiveness of influencer marketing and are not searching for something new.

23% of Respondents Intend to Spend More Than 40% of Their Marketing Budget on Influencer Marketing

Influencer marketing is, of course, merely one part of the marketing mix. Most businesses balance their marketing budget across a wide range of media to reach the greatest possible relevant audience. However, as we saw above, 82% of our respondents' firms intend to include some influencer marketing in their mix.

This year, we saw a noticeable trend in firms devoting a sizable percentage of their marketing budget to influencer marketing. Clearly, quite a few brands have found success with their influencer marketing and decided to return for more.

23% of respondents are dedicated fans of influencer marketing, intending to spend more than 40% of their marketing budget on influencer campaigns. This is a decided increase on 2022’s 5%, 2021's 11%, and 2020's 9%.

13% of respondents (up from 9% in 2022) intend to devote 30-40% of their marketing budget to influencer marketing. An additional 18% plan to allocate 20-30% of their total marketing spending to influencer marketing. This is down on last year’s 28% and 2021’s 19% assigning this level of marketing budget.

The most common percentage of marketing devoted to influencer marketing again comes in the 10-20% range, with 25% of respondents intending to spend in this range, but this is down significantly on 2022’s 39%. 20% expect to spend less than 10%, similar to last year’s result.

Although Most Brands Spend Less Than $50K on Influencer Marketing, More Than 11% Spend Over $500K.

Brands of all sizes participate in influencer marketing. Therefore, it should be no surprise to see quite some variation in what firms spend on the activity. 43% of the brands surveyed said they spend less than $10K annually on influencer marketing (higher than last year's 37% - these are probably newcomers dabbling with influencer marketing). 22% spend between $10K and $50K (down from last year’s 30%). A further 14% spent $50K to $100K (higher than in 2022), 10% $100K to $500K (unchanged), with a noticeable 11% spending more than $500K (nearly 3x more than last year).

Clearly, the amount that a firm spends depends on its total marketing budget affects the proportion it chooses to devote to influencer marketing. Those brands that opt to work with mega-influencers and celebrities spend more than brands that work alongside micro- or nano-influencers. Last year we saw a leveling out of influencer marketing spending, with most brands spending a middling proportion of their marketing budget on influencer marketing. This year, however, brands have moved to the extremes. Brands with happy influencer marketing experiences have increased the percentage of their marketing budget they spend on the activity. However, brands that have experienced less happy outcomes have decreased or eliminated spending on the activity, turning their attention to other forms of marketing.

Firms Value Working with Influencers They Know

We asked our respondents whether they had worked with the same influencers across different campaigns. The majority, 61% (57% in 2021) said they had, versus 39% (43% in 2021) who claimed to use other influencers for their campaigns (or perhaps had only had one campaign so far). These figures are little changed from those reported in 2021.

Clearly, brands prefer to build relationships with existing influencers rather than go through the entire influencer selection process every time they run a campaign. Of course, some firms will have a range of influencers they call upon depending on the nature of a particular campaign, the products they are trying to promote, and the target market. The 4% increase in firms working with existing influencers probably indicates the natural increase in influencer-business relationships over time. The more successful an influencer campaign is, the greater the likelihood that the parties will want to work together on other campaigns.

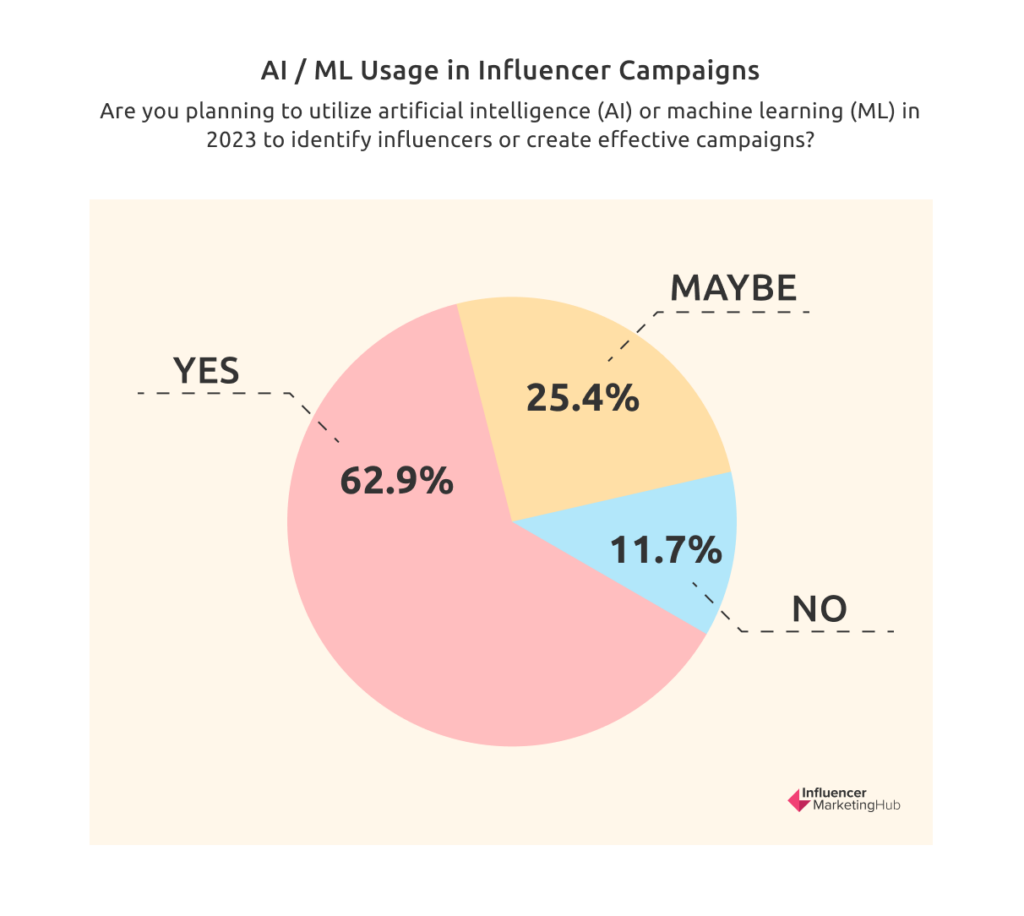

More Than 60% Plan to Use AI or ML in Their Influencer Campaigns

Technology is coming to influencer marketing. We asked a new question for 2023’s Benchmark Report about whether the respondents planned to utilize artificial intelligence (AI) or machine learning (ML) in 2023 to identify influencers or create effective campaigns. A very sizable 62.9% said they would, alongside 25.4% who thought they may. Only 11.7% gave an unequivocal no to this question. Clearly, AI and ML are now hitting the mainstream.

The Main Purpose of AI/ML Will be for Influencer Identification

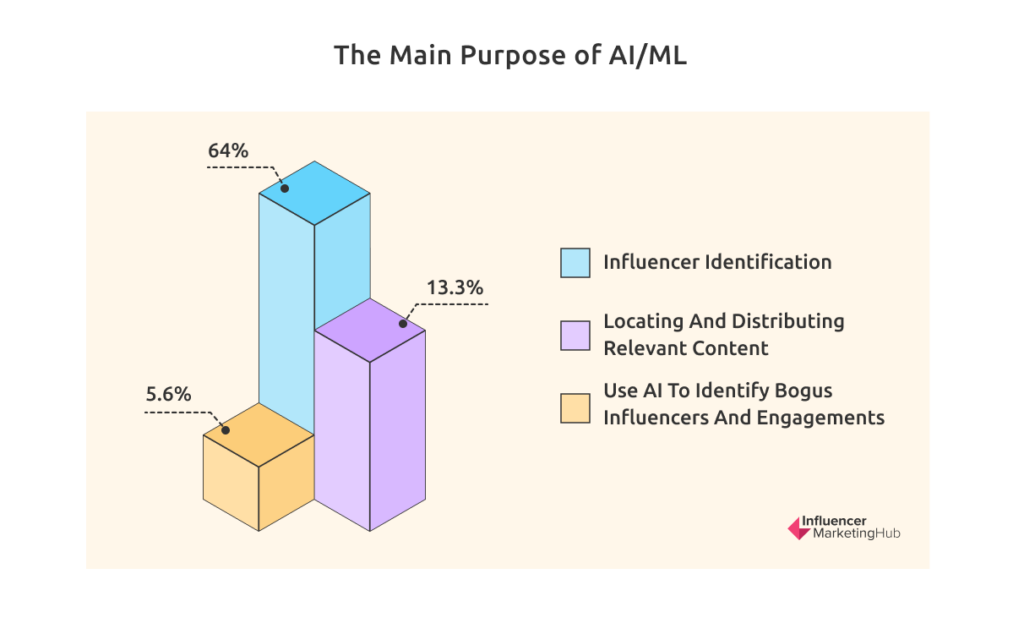

We asked those who said they would (or might) use AI/ML in their influencer marketing how they intended to use it. The most popular suggestion (64%) was using social media analytics to identify the most effective influencers for a particular brand or campaign. Although the respondents didn’t clarify this, they presumably intend to work with one of the influencer platforms offering influencer identification technology.

Although somewhat less common, the second most popular intended use of AI in influencer marketing is locating and distributing relevant content (13.3%).

Interestingly, 5.6% of the respondents intend to use AI to identify bogus influencers and engagements. It will be interesting to see if this figure rises over time, as more people discover what AI can achieve.

TikTok Still Expected to Deliver the Best ROI for Short-Form Video

Until recently, the name TikTok was synonymous with short-term video, although ardent Snapchat fans may dispute this assessment. However, existing social media companies, YouTube and Meta (Facebook/Instagram) have been hit by the popularity of comparative newcomer, TikTok. Just as Instagram introduced Stories to try and neuter Snapchat, these older social channels have now introduced TikTok-killer features. You will undoubtedly notice YouTube Shorts, Instagram Reels, and now Facebook Reels in your feeds.

We asked our respondents about which they believed would deliver the best ROI in 2023 (we didn’t include Facebook Reels in our survey options), and discovered a relatively close battle for the top position between TikTok (42%) and Instagram Reels (34%). 19% believed YouTube Shorts would deliver the best ROI, alongside a few SnapChat disciples, with 6% opting for SnapChat Spotlights.

Strong Preference for Smaller Influencers

We asked those of our respondents intending to work with influencers this year the size of influencer (in terms of followers) they were most likely to utilize. If they used more than one type, they had to pick their most preferred option.

39% of brands chose nano-influencers (1K-10K followers) as their most likely partners, followed by 30% opting for micro-influencers (10K-100K).

Far fewer brands chose to place their focus on larger influencers, with 19% opting for macro-influencers (100K-1M) and 12% mega / celebrity influencers.

This possibly reflects the reality of a small to medium-sized business. You simply can’t afford the fees charged by macro and mega-influencers. In addition, there are far fewer of these more popular influencers, limiting the number of brands they can work with. However, it may also reflect that nano and micro-influencers have far higher engagement rates than their more famous counterparts, and may be better value for money for brands wanting to reach a specific dedicated audience.

More Brands Now Pay Influencers Than Give Them Free Product Samples

There has been a notable change in the answers to this question over the last few years. Previously, those giving free samples outnumbered those paying cash to influencers. Last year, numbers were approximately equal. However, this year, noticeably more respondents (41.6%) stated that they pay money to influencers, compared to 29.5% who give them free products. In addition, 17.7% gave their influencers a discount on their product or services (presumably more expensive items), and a smaller 11.2% entered their influencers in a giveaway.

While more brands are willing to pay influencers for their marketing services, 41.6% is still a relatively low percentage, much less than half. It is probably a sign of just how many firms work with micro and nano-influencers. These relative newcomers are happy to receive payment in kind rather than cash. Presumably, it is mainly larger firms with more sizable marketing budgets that pay influencers with money. However, this is gradually changing as even nano and micro-influencers begin to have an understanding of their worth as advocates for a brand.

Major Change in Payment System This Year: More Than Half of Payments to Influencers are Made as a Percentage of Sale

As we prepare the State of Influencer Marketing Benchmark Report annually, we don’t generally tend to see major changes in survey results each year. In most cases, movement is evolutionary rather than revolutionary. However, this question evoked significantly different answers compared to a year ago.

For the first time last year, we asked those respondents who paid their influencers a new question about how they structured their monetary rewards. The most common method (49%) was paying at a flat rate. However, a sizable percentage of other brands (42%) structured their influencer marketing payments more like affiliate marketing payments by paying a percentage of any sales made as a result of the influencer marketing. Payments based on product level (4%) and tiered incentives (4%) were less common.

This year, however, things changed considerably. The most common method (53%) now is paying as a percentage of sales value. Payments based on product level (21%) are five times as popular as a year ago. Respondents favoring flat rates have more than halved to 19.6%, and those paying by tiered incentives remain low at 6.9%.

It’s hard to understand the reason for such a significant change. Perhaps in these tough economic times brands are requiring a higher level of evidence for the effectiveness of their influencer marketing spending. Possibly more brands engaging in influencer marketing have made increased sales the goal of their campaign, and fewer targeting brand awareness. It will be most interesting to see how this metric trends next year.

PayPal is Marginally the Most Popular Way to Pay influencers, However, Other Methods Are Almost as Common

Isolating those respondents who pay money to influencers, we asked them their preferred payment method. 29% chose PayPal (down from 34% last year), 28% paid by wire transfer (18% last year), 25% said they paid manually (24% last year), and 17% a third-party payment service, e.g., Wise (24% last year). Manual payments include payments made by cash on delivery (COD), money orders, bank transfers, and even email money transfers in some locations like Canada.

Payment methods depend very much on the location of the influencers. If they are based in a different country from where you operate, PayPal or something like Wise is much easier than a wire transfer or a manual transaction.

Nearly 75% of Brands Track Sales from Influencer Campaigns

Although there are many potential goals for an influencer marketing campaign, it is clear that the majority of firms now undertake influencer marketing to drive sales. Indeed 74% of our survey respondents stated that they track sales from their influencer campaigns.

This is up slightly from last year’s 70% and ties in with the previous statistic indicating that the most popular basis for influencer payment is now tied to the increased sales an influencer’s activity generates. As influencer marketing has evolved new ways to measure success have developed, with specialist platforms assisting brands alongside a recent streamlining of Google Analytics. However, as we see in the next statistic, there is also now more tracking of email addresses than previously.

Email Addresses and Referral Links are the Most Popular Ways to Attract Sales

Those who tracked sales from their influencer campaigns were asked about their methods of determining these influencer-generated sales. People could select multiple options if they used more than one.

The most common method was to use email addresses (31%), closely followed by referral links (30%). Other methods used included coupon codes (12%), product SKUs (5%), and “other” (21%). This movement towards tracking by email addresses is significant, as only 16% of brands did so last year.

80%+ Recognize the High Quality of Customers from Influencer Marketing Campaigns

Brands carry out influencer marketing for a range of purposes. Some campaigns are designed to increase brand awareness rather than encourage sales. This is because some customers are more lucrative for a business than others – they buy high-margin products and add-ons. In some cases, influencer marketing may bring new customers to the brand, but the additional spending may be less than the cost of running the campaign.

Our survey respondents are highly optimistic about the value of influencer marketing overall. Most agree that influencer marketing attracts high-quality customers, with 82% believing that the quality of customers from influencer marketing campaigns is better than other marketing types.

60% of Respondents Have Used Virtual Influencers

This was a new question in 2023, and the results are somewhat surprising. When asked about whether they had ever used virtual influencers, 60.4% admitted to having done so.

A virtual influencer is a digital character created using computer graphics software. The character is given a personality and acts on social media platforms as if he/she is an influencer. A study in the US found that 58 percent of respondents followed a virtual influencer. In 2022, Lu do Magalu was the most followed virtual influencer, with more than 14.6 million followers on Facebook, 6 million followers on Instagram, more than 2.6 million YouTube subscribers, and over 1.3 million followers on both Twitter and TikTok.

Therefore, it should come as no surprise that brands are taking notice of this and wanting to make financial arrangements with (the representatives of) these virtual influencers.

71%+ Measure the ROI on Their Influencer Marketing

We saw above that 75% of our survey respondents stated that they track sales from their influencer campaigns. Therefore, it should be no surprise that a similar number (71%) also measures the ROI from their influencer campaigns. This slightly improves on 2022's 70%, 2021's 67%, and 2020's 65% results.

Indeed, this year's 71% is the highest rate we have seen since the inception of this survey, with the results since 2017 all falling in the range of 65-71%. It is somewhat surprising that just under 30% of firms don't measure their ROI. You would think that every firm would want to know how effective their marketing spending is. At least there is a gradual improvement in this metric, and hopefully, this trend will continue, if not accelerate.

The Most Common Measure of Influencer Marketing Success is Views / Reach / Impressions

This result shows a marked change from previous years, yet it seems inconsistent with increases in firms tracking sales and paying influencers based on the sales they generate.

In 2019 and preceding years, influencer marketing measurement's focus was relatively evenly balanced between differing campaign goals, but Conversion/Sales was the least-supported reason. However, in 2020 things changed, with Conversions/Sales taking a clear, undisputed lead, which continued in 2021 and 2022. However, this year, 49.6% of our respondents stated that they measure the success of an influencer marketing campaign by views/reach/impressions, 25.5% by engagement or clicks, and just 24.9% by conversions/sales.

This differs markedly from last year when 42.3% believed that you should gauge a campaign by the conversions/sales that result, 33.5% were most interested in engagement or clicks generated due to a campaign), and 24.2% were interested in views/reach/impression.

Most Consider Earned Media Value a Good Measure of ROI

Earned Media Value has become more recognized in recent years as a good measure of influencer campaigns' ROI. We asked our respondents whether they considered it a fair representation. This year, 83% favor the measure against 20% who don't. This result is up slightly from last year.

Earned Media Value provides a proxy for the returns on the posts that an influencer has historically given the firms they have worked with. It indicates what an equivalent advertising campaign would cost for the same effect. EMV calculates the worth you receive from content shared by an influencer.

The only negative of using this measure is that the calculation of EMV can be complicated. As such, it can sometimes be difficult for marketers to explain the concepts to their managers.

Another name used for earned media value when related to influencer marketing is influencer media value (IMV), which we have written about in What Exactly is an Influencer's Media Value.

Presumably, most of the 17% against using the statistic either don't understand it or struggle to communicate its worth to their management team.

83% of Firms Take Their Influencer Marketing Spending from Their Marketing Budget

This is another statistic that has shown little change over the period we have undertaken this survey (since 2017). 83% of the respondents in our survey take their influencer marketing spending from their Marketing Department's budget. The remaining 17% take their influencer marketing spending from their PR Department's funds.

Presumably, the firms in the minority group use influencer marketing predominantly for awareness purposes rather than as a direct means to sell their products or services.

72% of Influencer Marketing Campaigns are Run In-House

There has been little change in this statistic this year. A marginally higher 72% of our survey respondents claimed that they ran their influencer campaigns in-house, with the remaining 28% opting to use agencies or managed services for their influencer marketing.

In the past, firms found influencer marketing challenging because they lacked the tools to facilitate the process – organic influencer marketing can be very hit-and-miss, making it frustrating for brands trying to meet their goals. However, many firms now use tools (whether in-house or from third parties) to facilitate the process. For example, they use platforms like HypeAuditor to discover suitable influencers.

Some brands prefer to use agencies when partnering with micro and nano-influencers because the agencies are more experienced at working with influencers at scale. Also, many larger firms use agencies for all their marketing, including influencer marketing.

71% of Respondents Use Tools Developed In-House to Execute Influencer Marketing Campaigns

Last year, we introduced a new question asking our respondents whether they used any tools developed in-house to execute their influencer marketing campaigns. The result was that half admitted to using their own tools.

This year, however, we noticed a significant change. 71% of our respondents now use in-house tools for their influencer marketing campaigns.

As influencer marketing becomes more mainstream, more businesses have developer talent in-house who have the time and capabilities to develop suitable in-house tools.

60% of All Respondents Use 3rd-Party Platforms

Just as more firms use in-house tools for influencer marketing compared to a year ago, noticeably more also use third-party platforms. When asked whether they use third-party platforms to assist them with their influencer marketing, 60.3% said they did (44.6% in 2022).

A clear majority of firms now recognize the advantages of using technology to assist them with their influencer marketing.

We must also remember that these figures exclude brands that opt to use someone else's technology (an agency) to carry out much of their influencer marketing for them).

The Most Popular Use of Influencer Platforms is for Influencer Discovery and Communication

The figures in this section show a percentage of those who answered that they use a third-party platform, not the percentage of all survey respondents as a whole.

Influencer platforms initially focused on offering tools to help with influencer discovery. Therefore, it should be no surprise that that is still the most popular use of influencer platforms at 55% (although down slightly from last year's 58%).

Other popular uses of the influencer platforms include influencer payments (30%), campaign automation and reporting (30%), fraud and fake follower analysis (26%), conversion attribution (23%), and paid amplification (21%). An additional 26% of respondents use the platforms for some other type of service.

Interestingly many of these percentages are lower than in 2022, but the 26% selecting Other is significantly higher. Clearly, the range of services offered by the platforms has expanded, and many forms now use their newer features.

TikTok is Now the Most Common Channel Used by Most Brands Engaging in Influencer Marketing

It was in 2021 that TikTok made its first appearance in our charts, rising from merely being lumped in "Other" in 2020 to 45% usage in 2021. It kept its popularity in 2022, increasing slightly to 46%, but dropping a position to third. In 2023, however, TikTok has come into its own, taking over first place, used by 55.5% of brands tapping into it for influencer marketing campaigns.

From the inception of the IMH Benchmark Report in 2017 until last year Instagram was the network of choice for influencer marketing campaigns. In 2022 it was used by 79% of our respondents for influencer marketing. It is still highly popular, but this year “only” 50.8% of brands go to Instagram when they decide to participate in influencer marketing, dropping it down to second place.

It wasn’t all that long ago that Instagram was synonymous with influencer marketing. Is it losing its luster? Time will tell.

Surprisingly, Facebook jumped in popularity as an influencer marketing channel last year, with 50% of brands working with Facebook influencers, although this fell back to 42.1% this year. Facebook doesn't have as many high-profile influencers as its more visual counterparts, but it is still relevant, particularly with older audiences. Perhaps brands have been targeting older Millennials, Generation X, and Baby Boomers with their influencer marketing than previously.

Many of the other social channels have seen reduced usage for influencer marketing compared to last year. For example, 38.3% of the respondents tapped into YouTube for their campaigns (44% last year), 14.4% Twitter (23% last year), 10.1% LinkedIn - presumably those involved with B2B companies (considerably down from 20% last year), 6.3% Twitch (11% last year) and a further 12.8% spread across the less popular or more specialist social networks (up from 7% last year).

Twitter’s drop in importance for influencer marketing is notable. Has Elon Musk’s Twitter purchase killed confidence in the platform, or is he a white knight rescuing an already-fading platform?

User Generated Content (UGC) is Now the Main Objective for Running an Influencer Campaign

The answers to this question this year are markedly different from those in 2022. At that stage 36.7% of our respondents claimed their influencer campaign aimed to increase sales, 35.7% focused on awareness, and 32.8% declared they engage in influencer marketing to build up a library of user-generated content.

This year, however, the wish for generating UGC jumped ahead as the main reason for influencer marketing campaigns (45%), with Sales (29%) and Awareness (26%) both noticeably reduced in importance.

Perhaps this is a sign of the increased importance of TikTok to influencer marketing – TikTok is now the natural home of UGC, with many brands engaging influencers to set up dance challenges and the like on their behalf.

Influencer Fraud is Still of (Some) Concern to Respondents

Every so often, mainstream media highlights influencer fraud. Luckily there are now many tools to help detect fraudsters, reducing the effects of influencer fraud. Hopefully, it will soon merely be a chapter in the industry's history.

However, influencer fraud has not been wholly vanquished from brands' and marketers' minds yet. There has been less publicity about influencer fraud in this Covid era than previously; however, 64% of firms still have worries about the practice.

Several influencer platforms have recognized this area of concern over the last few years and implemented tools to discover and deter influencer fraud. This may be one of the reasons that this statistic has gradually fallen over each of the last few years.

Continued Fall in Respondents Who Have Experienced Influencer Fraud

Despite concerns about influencer fraud falling, the number of firms that say they have experienced it rose dramatically from 31% in 2022 to 55% this year. The wording of this question looks at any influencer fraud over time, not just in the past year, but nonetheless, there appears to have been a noticeable increase, despite all the tools now available. Is this a sign of increased influencer marketing fraud levels, or is it an indication that businesses are now better at spotting fake “influencers” with whom they have engaged?

Brands are Finding it Relatively Easy to Find Appropriate Influencers

Last year we commented on seemingly inconsistent results to this question. This year, however, things are looking more clear-cut – although those who consider finding appropriate influencers to be of “medium” difficulty are still the largest category (45% down from 63% in 2022), with 37% declaring finding influencers to be easy, that just leaves 18% who considered finding appropriate influencers to be very difficult.

Perhaps the best way to look at this statistic is that 82% don't consider it very difficult to find appropriate influencers. This suggests that brands benefit from having more platforms and other influencer discovery tools available than ever (as well as influencer agencies for those wishing to outsource the entire process). Firms frequently reuse influencers with whom they have worked in the past. Some brands still struggle to find suitable influencers, however, perhaps because they are unwilling to pay for the relevant tools or platforms.

This statistic suggests that influencer platforms and agencies can still do a better job at marketing their services of discovering and reaching out to potential influencers.

The Majority of Firms Have Little Concerns About Brand Safety in Influencer Campaigns

A headline-making issue in past years was influencers acting in a way deemed inappropriate by the brands they represent. For example, Logan Paul once faced criticism over a tasteless video he shared, and brands wondered whether they should continue their connection with him. YouTube has also implemented stricter rules for channels targeting children after concerns about the suitability of some content.

The key to successful influencer marketing is matching your brand with influencers whose fans are similar to your preferred customers and whose values match your own.

A slightly increased 36% of our respondents believe that brand safety is always a concern, although a much reduced 33% acknowledge that brand safety could occasionally be a concern when running an influencer marketing campaign.

The remaining 31% (significantly increased) believe it is not really a concern. Presumably, this last group has mastered the art of finding appropriate influencers for their brands, and they have little concern about incongruent values.

More Than 75% Believe Influencer Marketing Can be Automated

A contentious issue in influencer marketing in the past was the amount of automation you can successfully use. Some people believe you can automate virtually everything from influencer selection to influencer payment. Others value the personal touch and think influencer marketing is a hands-on process.

This year there has been a significant increase in the respondents believing that automation plays a vital role in influencer marketing (77%, up from 56% last year). This ties in with other results that indicate that most businesses using influencer marketing are happy to use tools and platforms (or work with agencies that do so) nowadays. Initial suspicions about AI and automation have dramatically lessened over the last few years.

Content Production is Now Considered Most Valuable When Partnering with Influencers, But Audience Relationship is Still Valued

The most important factor when partnering with influencers for survey respondents is content production at 36% (noticeably up from last year's 24%). This ties in with the view that user-generated content is the primary objective when running an influencer campaign.

29% of the survey respondents believed audience relationship to be the most valuable factor when considering collaborating with a particular influencer. This is noticeably down on last year's 51% and indicates a return to views expressed in 2021. These respondents see little value in working with somebody who doesn't really influence their audience or perhaps has an excellent relationship – but has the wrong audience for that brand.

The third popular reason favored by 17% of our respondents (up from 14%) found for working with influencers is distribution. Although this is lower than the other options, it connects with audience relationships – influencers use their audience to distribute content relating to a brand.

7.5% of our respondents opted for attribution and tracking (6% in 2022). This ties in with those who worked with influencers to generate sales for their partner businesses.

60% of Respondents Prefer Their Influencer Marketing to be Campaign-Based

We have seen more brands cultivating long-term relationships with influencers in recent times. Yet, most brands still think in terms of influencer marketing campaigns. Once they complete one campaign, they plan, organize, and schedule another one. Brands find that influencers they have worked for on previous campaigns are more genuine. Despite this, a significant 60% of influencer marketing relationships are campaign-based (albeit down from 72% in 2022), with only 40% "always on" (28% last year).

While numbers have shifted towards long-term relationships this year, the overall pattern is still clearly campaign based.

This could represent more brands entering the industry, dipping their toes in the water before making long-term commitments to influencers. Alternatively, they may run multiple campaigns, selecting a preferred selection of influencers for each campaign, depending on the target market. Time will tell whether the nature of brand-influencer relationships changes in any significant way.

The Vast Majority Consider Influencer Marketing to be a Scalable Tactic in their Marketing Ecosystem

One of the most significant advantages of influencer marketing over social activity using official company accounts is the ease of scaling the activity. If you want to create a more extensive campaign, all you need to do is work with more influencers, particularly those with larger followings – as long as they remain relevant to your niche.

While organic influencer marketing may be challenging to scale because of the time needed for influencer identification and wooing, there are now approximately 18,900 Influencer Marketing related services/companies worldwide that businesses can use to help scale their efforts. Many of these operate globally and accept clients from anywhere in the world.

57% of our respondents believe that influencer marketing is definitely a scalable tactic in their marketing ecosystem, and a further 26% think it is somewhat of a scalable tactic. Only 14% disagree totally with the sentiment, although that is noticeably higher than last year’s 9%. The vast majority recognize that influencer marketing is, to some extent, a scalable tactic in their marketing ecosystem, but it would be interesting to know what has caused more to disagree with the sentiment this year than last.

Views/Reach/Impressions Are Now the Most Important Criteria When Evaluating Influencers

We have regularly seen that businesses have a variety of objectives when they create influencer marketing campaigns. While the criteria by which our survey respondents evaluate influencers do not precisely match their differing goals, there is some clear correlation.

We have noticed elsewhere that brands have changed their most common reasons for working with influencers. This has also flowed through to how they evaluate the success of influencers at meeting goals.

This year 35% of our respondents consider views/reach/impressions to be the most important criterion (21% last year), while 19% opted for content type/category (compared to 23% last year). At 18%, Sales has noticeably more appeal than last year (11%) after being mixed in with Other in earlier benchmark reports.

17% of our respondents rated engagement or clicks as their most important criterion. This is a major decrease from 2022, where 39% opted for this category, ahead of everything else. The remaining 10% of the respondents have different ideas on this topic, opting for Other as the most important criterion when evaluating influencers.

60%+ of Brands Work with More Than 10 Influencers

We asked those respondents engaged in influencer marketing how many influencers they had worked with over the last year. This year we noticed a movement towards working with greater influencer numbers. 39% of our respondents stated that they had worked with 0-10 influencers (54% last year). A further 21% had worked with 10-50 influencers (24%) and 16% had worked with 50-100 influencers (14%).

Some brands prefer to engage in influencer marketing on an even larger scale, with 11% of those surveyed collaborating with 100-1000 influencers (5%). A significant change was the 12% who worked with more than 1,000 influencers, compared to just 3% last year.

These figures probably indicate just how many brands now collaborate with multiple nano- and micro-influencers, rather than just a few macro-influencers and celebrities.

Monthly Campaigns Are Now the Most Used, With the Use of Quarterly Campaigns Falling Dramatically

We saw a gradual movement in favor of quarterly campaigns over the last few years, to the point where it was the most popular campaign type in 2022, but this year the longer campaign period fell dramatically out of fashion.

Of those who operate discrete influencer campaigns, 48% (up from 34%) now prefer to run them monthly. A further 18% (down from 35%) run quarterly campaigns. Just 15% (up fractionally from 14%) prefer to organize campaigns annually. These later companies are probably brands that like the "always-on" approach to influencer marketing. The remaining 19% (up from 18%) take a different approach and only run campaigns whenever they launch a new product.

Finding Influencers to Participate is Again the Greatest Challenge for Those Who Run Campaigns In-house

We asked those survey respondents who ran campaigns in-house what they saw as the greatest challenges they faced. Traditionally, the most significant challenge was finding influencers to participate in their campaigns, but last year it dropped into second place. In 2023, it returns to the top as the biggest challenge for influencer marketers. Despite the increase in usage of both internally developed and external tools to ease the discovery process, 36.3% of respondents ranked this as their top concern (27.4% last year).

Another category to jump up the rankings to 15.3% was processing payments to influencers (from 8.3%).

This year we saw a significant drop in 2022’s top concern, with 14.9% opting for measuring ROI and campaign results (28.1% last year).

Other notable areas of concern included managing the contracts/deadlines of the campaign 13.2% (14%), bandwidth/time restraints 6% (13.3%), and Other 14.2% (8.9%).

Our partner, HypeAuditor, provides much of the data for the next section, and it covers up until late 2022.

Social Media User Demographics Statistics

This section highlights statistics that emphasize the types of people most likely to use social media. When you are searching for influencers to promote your brands, you will want to focus on those influencers who are followed by the type of people most likely to be interested in your products or services. The social media network where each influencer has gained the most fame impacts this – clearly, you want to work with popular people on the same social networks where your potential customers spend their time. Remember, just because you spend time on a particular social network doesn't mean that your customers do too, particularly if they are of a different demographic than yourself.

The Majority of Instagram Users Are Aged 25-34

As with last year, the majority of Instagram users are people aged 25-34 (46.81%), followed by 18–24-year-olds (33.17%). In both cases, more females than males use Instagram, although the difference is less for 25–34-year-olds: 18-24 yr-olds (56% female: 44% male), 25-34 yr-olds (52% female:48% male).

For the second year, however, we notice that there are more male Instagram users than females in (almost) all older age groups. For example, the ratio of Instagram users aged 45-54 is 32% female:68% male, although this is based on low overall numbers. Does this indicate that older males are more likely to have an interest in graphics, design, and photography than their female counterparts?

We saw elsewhere in this report that Instagram has lost its spot as the “Top Dog” influencer marketing platform to TikTok. This is possibly a reflection of a lack of interest from Generation Alpha and a reduction in Generation Z – only 4.27% of 13–17-year-old females and 3.11% of 13–17-year-old males now use Instagram. This must have Meta wondering.

TikTok is the Favorite of 13–24-Year-Olds.

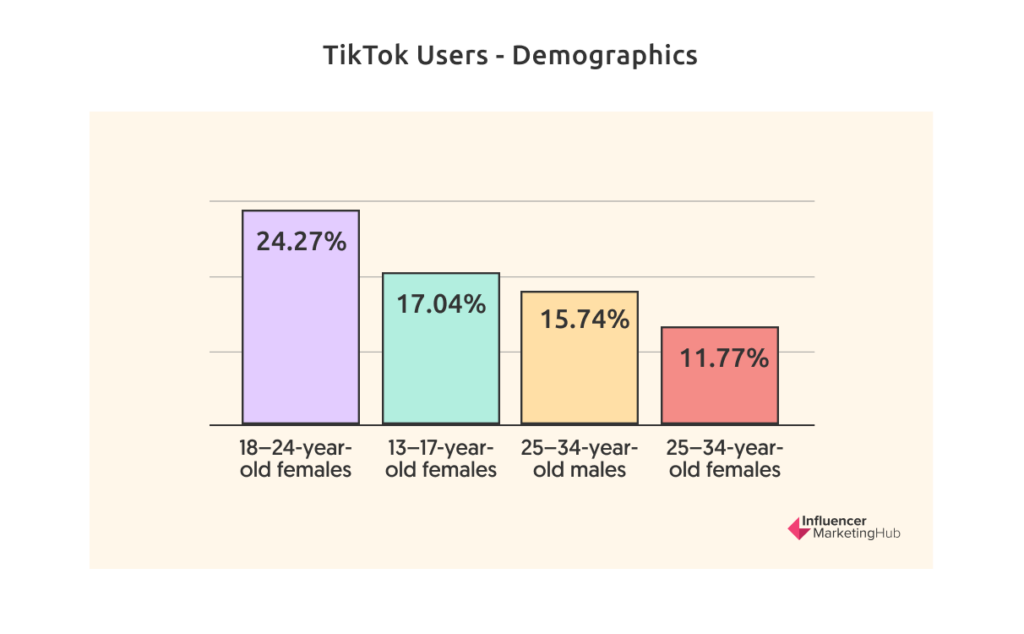

Anyone who thought TikTok was just a flash in the pan, ready to fade away as the next trend arrived, doesn’t understand the power of TikTok to hook its audience. If you want to reach 13-24-year-old females it is where you should focus your marketing. 24.27% of TikTok’s audience are 18–24-year-old females and 17.04% are 13–17-year-old females. Surprisingly, males take to TikTok later, with more 25–34-year-olds liking it (15.74% compared to 11.77% for females of that age), as they do with Instagram.

Also, like Instagram, there are more older TikTok male users (albeit still a very small percentage overall) than female users.

57% of YouTube Viewers Are Male, But Females Dominate the Younger Age Groups

As with Instagram and TikTok, more young females watch YouTube videos than males: Females 13-24 (26%) vs Males 13-24 (22%). However, in all other age groups, males are more likely to view YouTube videos.

Maybe this is because of the inherently passive nature of YouTube compared to TikTok – you can easily view YouTube videos like a traditional television – but you almost feel compelled to engage when watching TikTok videos.

We commented last year, how almost 1 in 5 YouTube views came from male Millennials (25–34-year-olds). This year, that group loves YouTube even more, and now watches 22.2% of all YouTube views.

Lifestyle and Music Top Instagram Influencer Niches

The most common niche in which Instagram influencers posted in 2020, 2021, and 2022 was Lifestyle. This is no great surprise when you consider which influencers are the best known to most people. In addition, lifestyle is an easy niche to share captivating, vivid images.

However, we have seen an interesting change in second place. The inherently non-visual category of Music now takes second place, with Beauty dropping to third. Is this a sign of Instagram’s male users having an impact?

Third-placed Beauty is highly visual, however, making it an ideal subject for posting on Instagram. Also, when you consider Instagram's core audience is still 25-34 females, it is hardly surprising that beauty influencers would remain relatively popular on the platform.

Influencer Engagement

Instagram Influencer Engagement Fell to Lowest Level in Five Years

In all the time we have reported on influencer marketing, we have observed a general pattern of Instagram accounts with large numbers of followers having a lower engagement rate than accounts with fewer followers. This is logical – it is much harder for popular influencers to reply to every comment and engage as closely with each follower as smaller Instagrammers. This is because people only have limited time to engage. Also, many people deliberately choose to follow popular influencers passively, happily "lurking," and viewing shared images without active participation.

We have seen a general reduction in engagement over the last few years, however, particularly for large accounts. Indeed, engagement for accounts with over a million followers (0.95%) is now less than half what it was in 2018 (1.97%).

Average engagement overall now stands at 2.05%, down from 2.18% in 2021. However, it is close to 2019’s pre-Covid rate of 2.08%.

TikTok Engagement is Considerably Higher Compared to Other Social Networks, Even for Large Influencers

We have observed elsewhere in this Benchmark Report how TikTok has now become the platform of choice for influencer marketing. Not bad for a social channel that we lumped under “Other” until a couple of years ago. One reason for this is undoubtedly the platform’s phenomenally high comparative engagement rates.

We’ve just written about how Instagram’s engagement rates range from 0.95% for accounts with over 100K followers to 4.21% for accounts with fewer than 5K followers. In comparison, TikTok’s largest accounts with over 1M followers average 10.53% engagement, and small accounts with 1K-5K followers have an incredible 15.04% engagement. No wonder more brands are wanting involvement there.

In one way, however, TikTok has become more “normal”. Last year, we reported the oddity that large TikTok accounts had better engagement than smaller accounts. This year, as we showed above, engagement levels picked up for the smaller accounts, meaning that TikTok now exhibits the normal distribution pattern again.

Larger YouTube Channels Have Better Engagement Than Smaller Channels

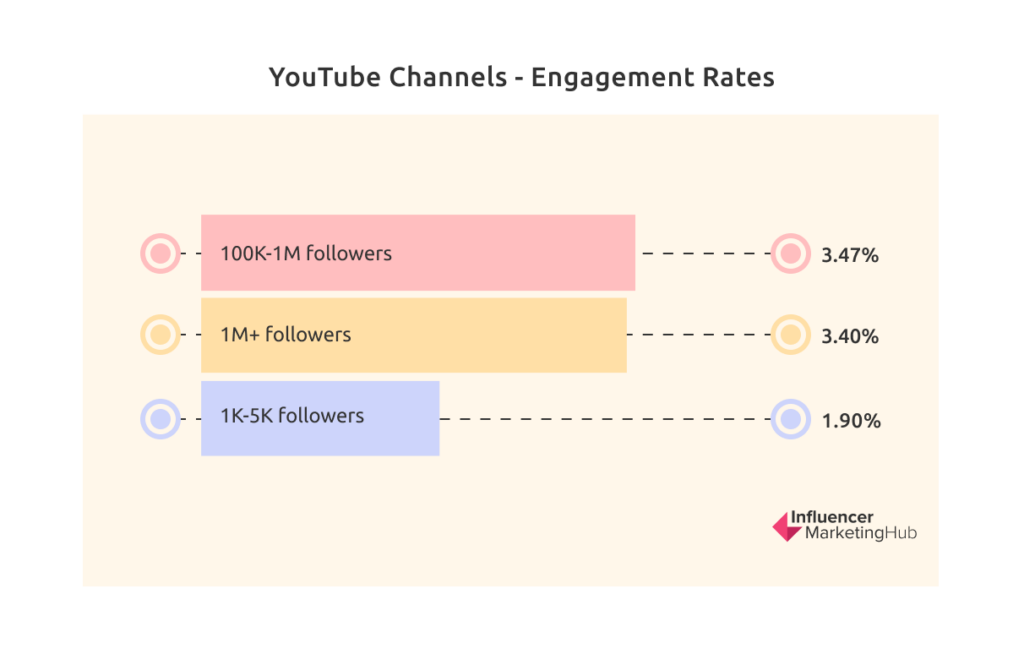

While TikTok may have returned to its usual engagement distribution pattern, YouTube hasn’t (quite) yet. Larger YouTube channels have higher engagement rates than smaller channels. Technically, channels with 100K-1M followers have the highest engagement rate (3.47%), but huge YouTube influencers (1M+ followers) aren't far behind (3.40%). In comparison, small YouTube channels with just 1K-5K followers only manage an engagement of 1.90%.

Instagram Influencer Fraud Has Continued to Decline Since 2019

In those heady pre-Covid days, influencer fraud became a significant discussion point. Indeed, there was a danger that influencer fraud could stop the still-nascent industry in its tracks.

Since then, there have been many tools and platforms developed that brands can use to detect influencer fraud. As a result, the percentage of influencer accounts impacted by fraud fell across the board. By 2021 it was just less than 50%. Rates fell further in 2022, reaching 36.68% on average. Unsurprisingly influencer fraud has had a much greater impact on larger Instagram accounts than on small ones, where fraudsters have less to gain.

As the data indicates, it is still a problem for some influencers, however. Also, as we saw in our Benchmark survey, more brands are now admitting to having been affected by fraud than ever before. It is advisable, therefore, that all brands use the available tools to ensure influencer authenticity when searching for suitable influencers.

Despite us lumping everything together as 'influencer fraud", in some cases, the influencers are the victims, not the perpetrators. For this report, we consider "influencers impacted by fraud" to be Instagram accounts with over 1000 followers with growth anomalies or inauthentic engagement (comments and likes from bots, giveaway comments, comments from Pods, etc.) Not all influencers impacted by fraud do so on purpose. On average, 36.8% of influencers globally are affected by fraud. This is down somewhat from last year’s 49.23%.

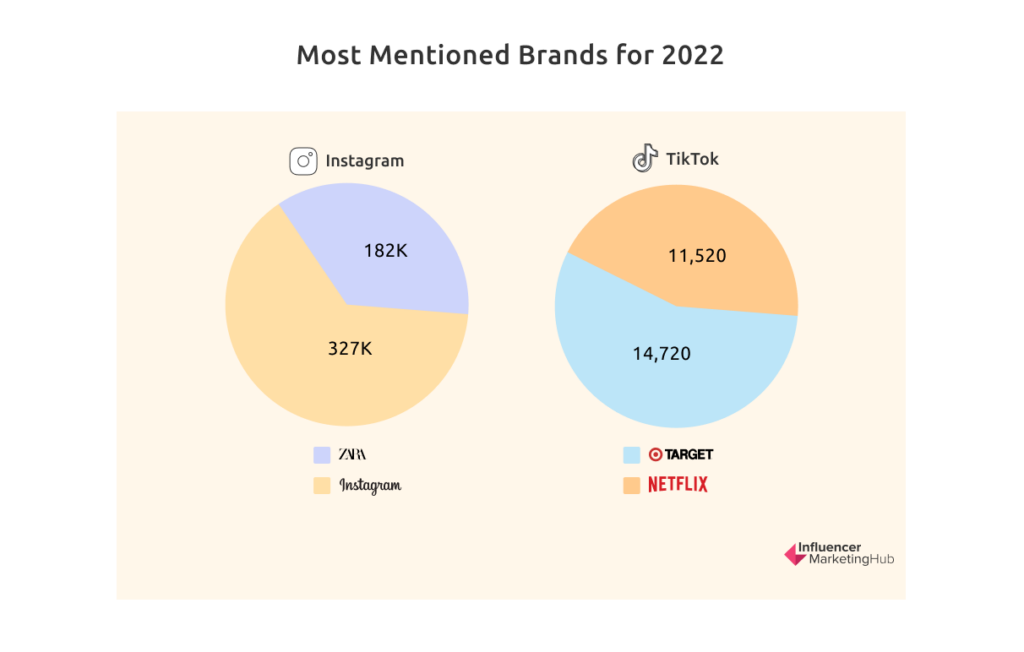

The Most-Mentioned Brands on Social Media in 2022

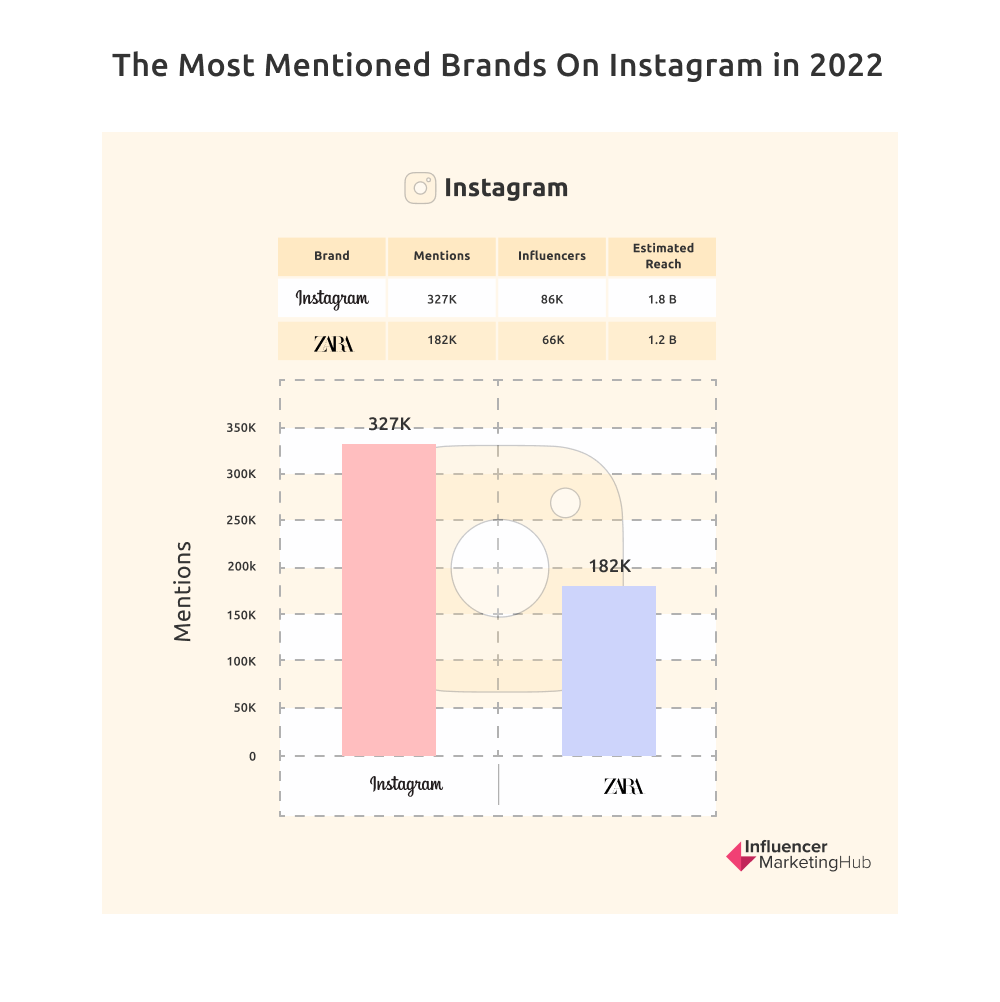

Zara Was the Most Mentioned Brand on Instagram in 2022 … Apart from Instagram Itself

Although Zara’s Instagram numbers were smaller than last year, they will be loving the 182K Instagram mentions they received in 2022. Of course, it helped that it had nearly 66K influencers posting and sharing about their products, with a combined reach of more than 1.2 billion people.

However, after a quiet 2021, Instagram once again took the engagement lead on its platform in 2022, with 327K mentions, 86K influencers, and an estimated reach of 1.8 billion.

We commented last year on how pleased YouTube must be to have the tenth most mentions on social rival Instagram. Well, this year YouTube improve on this, coming in eighth place.

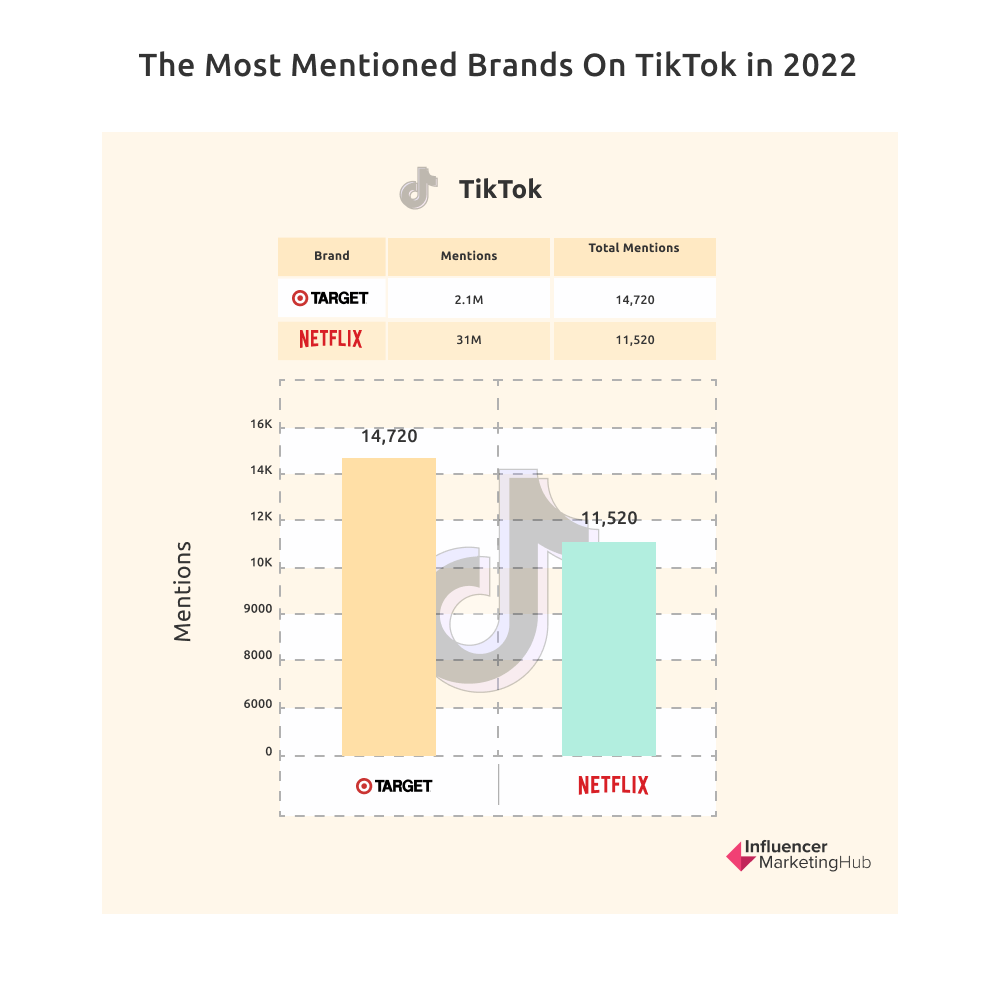

Target Was the Most Mentioned Brand on TikTok in 2022

In 2021, TikTok saw an interesting cross-brand trend, with the streamer, Netflix, being the most mentioned brand on the platform. When people weren't watching videos on Netflix, they were talking and making videos about what they'd streamed on TikTok.

Alas, Netflix couldn’t quite repeat the feat in 2022, however, although they almost did, being the second-most mentioned brand.

Top place in 2022 went to retail goliath, Target, which received 14,720 mentions compared to Netflix’s 11,520.

Notably, however, Netflix’s 31M followers swamped Target’s 2.1 million.

Highlights from our Diversity, Equity & Inclusion (DEI) in Influencer Marketing: Racial and Gender Inequalities Report.

Diversity, Equity, and Inclusion (DEI) in Influencer Marketing:

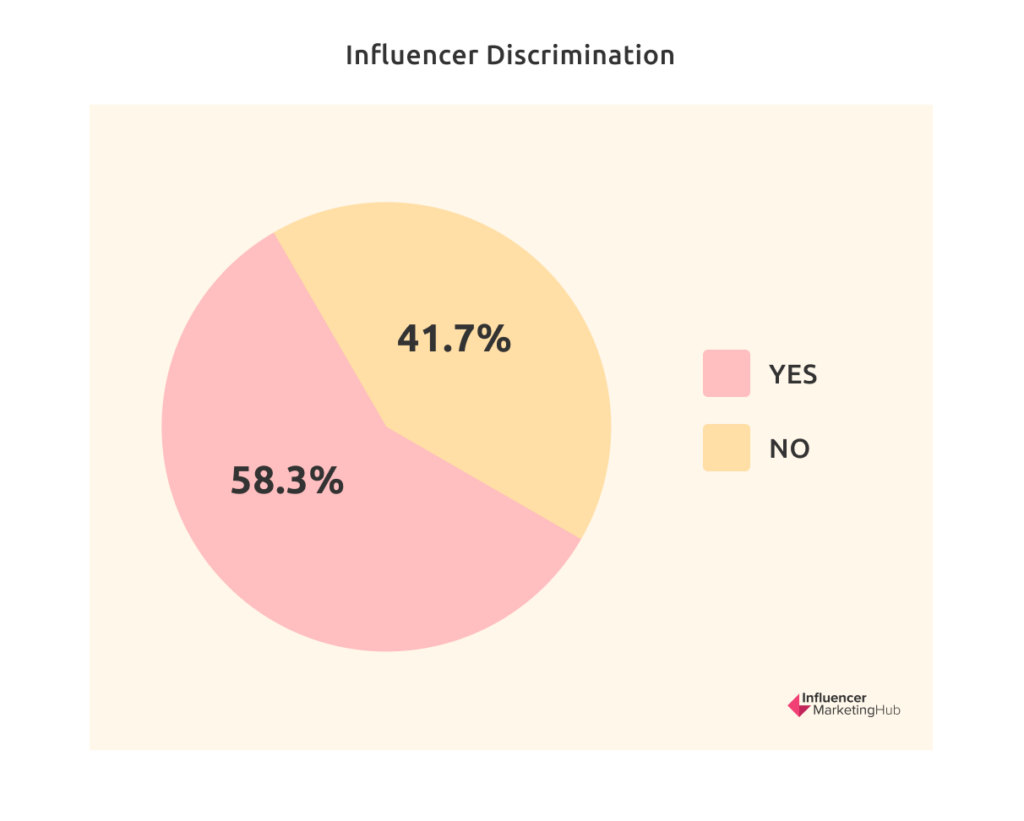

Nearly 60% of Influencers Felt They Faced Discrimination

We asked our influencers whether they feel they have ever been discriminated against (as an influencer) on any social platform. 58.3% stated they had, leaving 41.7% who hadn't.

Almost 50% of Influencers Face Discrimination Based on Their Gender

When asked to highlight an area of discrimination the respondents felt they had faced, 47.73% believed they had suffered from gender discrimination. Physical feature discrimination (21.75%) followed this, then racial discrimination (13.29%), political discrimination (9.06%), and sexual discrimination (8.16%).

TikTok Provided the Worst Discrimination Faced by Influencers

We asked influencers to name a channel where they encountered discrimination. Significantly more than half of those respondents who had faced discrimination received it on TikTok (58.42%), compared to YouTube (13.62%), Instagram (12.9%), and Facebook (10.04%).

We have seen elsewhere in this report that TikTok has been increasingly important for brands wishing to engage in influencer marketing. Yet is it not always an easy platform to establish yourself as an influencer, particularly if you are outside the “norm”.

Macro- and Mega-Influencers Suffer Most from Discrimination

Macro-influencers (81.25%) and Mega-Influencers (69.7%) are most likely to report facing discrimination than smaller, less popular influencers. This is possibly a reflection of their fame – they are more visible than most, making them greater targets for “haters.”